The Hidden Logic Behind D365 Finance Postings

One of the most common misconceptions I see among D365 Finance users is that clicking Post sends a transaction straight into the General Ledger.

In reality, what happens is far more structured — and understanding it is key to reconciling balances, auditing entries, and governing financial data effectively.

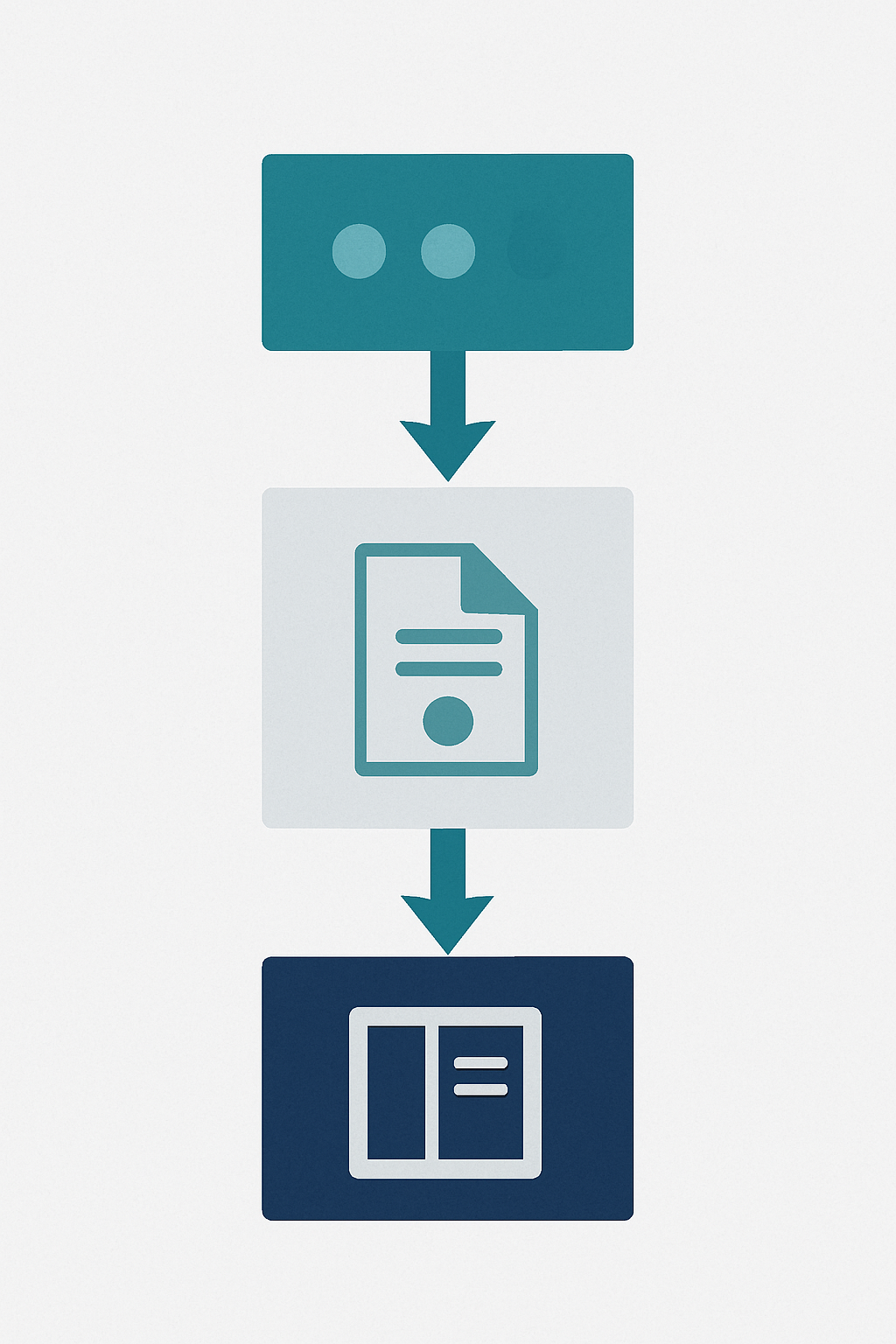

D365 Finance separates accounting data into three distinct layers:

- Subledgers — operational accounting modules (AP, AR, Inventory, Fixed Assets, Project)

- The Voucher — the bridge between operations and the General Ledger

- The General Ledger — the single source of financial truth

This layered approach ensures accuracy, traceability, and strong financial control.

1️⃣ The Layered Architecture: What Really Happens When You Post

When you post an invoice, payment, or journal in D365 Finance, the system follows this sequence:

- Creates subledger accounting entries — stored in

SubledgerJournalAccountEntry, with a header inSubledgerJournalEntry. - Generates a voucher — a unique identifier linking operational activity to accounting entries.

- Transfers the results to the General Ledger — creating summarized entries in

GeneralJournalAccountEntryand related ledger tables.

Each layer serves a purpose:

| Layer | Purpose | Example |

|---|---|---|

| Subledger | Captures operational detail | Vendor invoice lines, project costs |

| Voucher | Provides traceability | Unique voucher number across modules |

| General Ledger | Holds summarized, auditable entries | Final financial statements |

This process ensures that every accounting entry can be traced back to its operational source — a foundation for clean audits and confident financial reporting.

2️⃣ Why It Matters for Reconciliation and Auditing

Reconciliation issues in D365 often stem from misunderstanding this structure.

For example:

- A vendor invoice might exist in the subledger but never reach the GL if the voucher transfer fails.

- Manual GL journals posted directly to control accounts break the automatic traceability chain.

💡 Pro Tip: Always reconcile at the voucher level — it’s the single anchor between operational transactions and ledger entries.

3️⃣ Posting Types and Profiles: The Translation Layer

The bridge between subledger and ledger isn’t magic — it’s governed by posting types and posting profiles.

- Posting types classify the nature of each accounting entry (e.g., vendor liability, purchase accrual, issue of inventory).

- Posting profiles map those types to specific GL accounts, with setups stored in module-specific tables (

VendPosting,CustPosting,ItemPosting, etc.).

A single misconfiguration — for instance, an incorrect purchase accrual account — can silently distort your trial balance for months.

That’s why ongoing governance and periodic review of posting profiles are critical.

4️⃣ Common Pitfalls to Avoid

- Manual journals posted to control accounts → break reconciliation links.

- Changing posting profiles mid-year → creates historical inconsistencies.

- Ignoring voucher relationships → hours wasted tracing entries.

- No structured reconciliation routines → discrepancies accumulate silently.

- Over-reliance on Excel extracts for reconciliation → timing mismatches and missed transactions.

A good reconciliation practice always starts with D365’s native inquiry forms or Power BI data models rather than offline Excel dumps.

5️⃣ Governance Framework for Posting Control

D365 Finance’s flexibility is powerful — but without ownership, posting chaos can spread fast.

| Responsibility | Owner | Example |

|---|---|---|

| Define account structures and validation rules | Finance | Chart of accounts, dimension rules |

| Maintain posting profiles per module | Functional leads (AP, AR, FA, Inventory, Projects) | Vendor or item posting setup |

| Harmonize posting parameters across entities and environments | IT / System Admin | Consistent configuration deployment |

| Approve structural or mapping changes | Finance + Governance Committee | New dimension or posting logic approval |

Establishing clear governance ensures that every subledger posting reaches the ledger correctly and traceably.

Conclusion

Behind every posted transaction in D365 Finance lies a robust accounting process — subledger → voucher → ledger — designed for accuracy, auditability, and control.

Understanding this flow transforms troubleshooting into prevention and helps Finance leaders maintain a clean, trustworthy ledger.

✅ If you found this post useful, check out our related article:

Designing ERP Security Roles That Work: A Governance Approach to D365 Finance