The Strategic Role of Financial Dimensions: Better Insight Without a Bloated Chart of Accounts

1. The Problem with Bloated Charts of Accounts

Too many organizations fall into the trap of creating an over-engineered Chart of Accounts (COA). Every new reporting need turns into a new account — until the COA becomes bloated, confusing, and painful to reconcile.

- Harder to maintain

- More room for human error

- Slower to produce meaningful reports

A bloated COA doesn’t give you more insight. It just gives you more clutter.

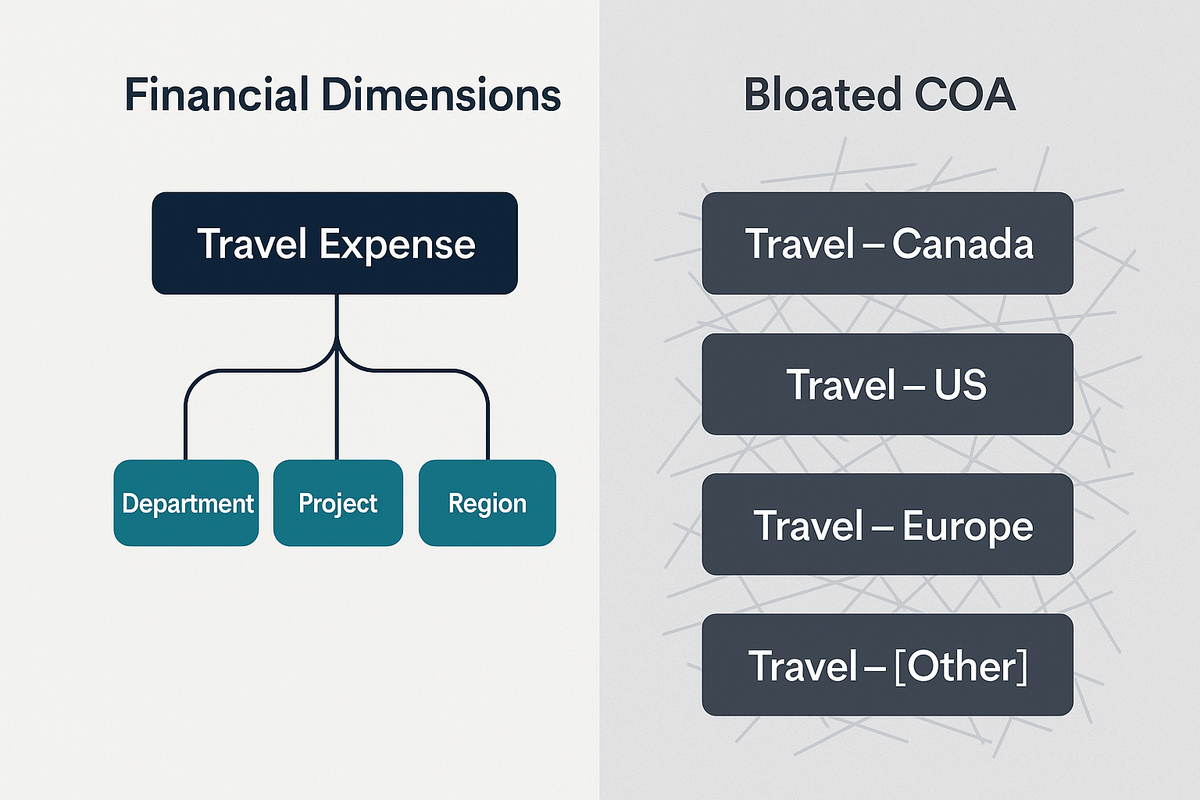

2. What Financial Dimensions Really Do

Think of accounts as the “what” — they capture the nature of the transaction.

Financial dimensions are the “context” — they explain the “why, where, or for whom.”

- Account = Travel Expense

- Dimension = Department, Project, Region, Purpose

Dimensions enrich your data without multiplying the number of accounts you have to manage.

3. Why CFOs Should Care: Strategic Advantages

When used correctly, financial dimensions bring:

- Clearer, faster reporting without endless accounts

- Agile decision-making (slice by project, department, geography)

- Consistency across entities without sacrificing flexibility

- Better alignment with business strategy (reporting mirrors how you manage)

- Scalable structure that doesn’t need constant redesign

Automation Benefits:

- Defaults: Dimensions can be applied automatically at multiple levels — vendor, item, customer, project, or even journal lines. This ensures consistency without extra manual input, reducing errors and freeing finance teams from repetitive coding.

- In Dynamics 365, entity-backed (standard) dimensions such as Project, Vendor, Customer, or Cost Center inherit their values automatically from the source record. This further reduces manual coding and ensures reporting accuracy.

4. Case Example: Dimensions vs. Accounts in Action

Imagine a global company with travel expenses:

- Bloated COA approach: Separate accounts for “Travel – Canada,” “Travel – US,” “Travel – Europe,” etc.

- Dimensions approach: One “Travel Expense” account, tagged with a “Region” dimension.

From a reporting perspective, users can extract the same information either way — the difference is how efficiently you get there. With dimensions, you avoid clutter while keeping reporting power intact.

Mini-example:

- Vendor default: Supplier “Air Canada” carries a default “Travel” dimension. Every invoice inherits it automatically. No need to re-tag every time — the system handles it.

5. ROI of a Well-Structured Dimension Strategy

The benefits show up directly in financial performance:

- Leaner COA → less maintenance and fewer errors

- Faster close cycles → finance spends more time analyzing, less time reconciling

- Sharper reporting → insights that actually guide decisions

- Scalable structure → supports growth without costly rework

New ROI point:

- Default + standard dimensions = fewer coding mistakes → cleaner reconciliations → faster month-end close.

6. How to Implement the Right Balance

- Keep accounts lean: focus on the natural “what.”

- Use dimensions to capture the business “context.”

- Challenge any new account request — could it be a dimension instead?

- From a reporting lens, remember: you’ll still be able to extract the same insights whether through accounts or dimensions — the choice is about structure, flexibility, and ease of use.

- Leverage defaults and standard dimensions: automate repetitive tagging, let system logic pull values from source data, but allow overrides for exceptions. This keeps reporting accurate and flexible.

- Rule of thumb: If something is required for statutory or regulatory reporting (e.g., legal entity accounts, tax accounts), it belongs in the Chart of Accounts. Everything else should go into dimensions.

🔑 Remember: you can still report either way — the insight is the same, but dimensions keep the COA leaner and easier to manage.

✅ With this approach, CFOs get the strategic view they need, while finance teams benefit from automation, inherited values, statutory compliance, cleaner data, and fewer headaches.